Volatility seems to be the status quo: War, stubborn inflation, financial market uncertainty, global energy shortages, rapidly rising interest rates and unprecedented bank defaults! When will we see a return to something a little more settled?

Data Highlights

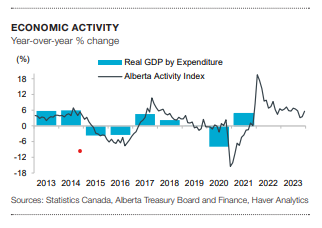

Alberta continues to hold strong resilience against economic pressures. Recent data revealed positive news: manufacturing shipments reached record levels – up 22% month over month, pushing the Alberta Activity Index to another historical high (see graph to the right). February saw gains in the labour market adding 1,600 jobs, an increase of 2.9% in retail sales and 11% in housing starts. Annually, drilling rigs were up 7% and the Alberta population expanded another 3.7% with a net inflow of 45,526 interprovincial migrants (Government of Alberta).

On the Horizon

Despite several Bank of Canada hikes in the policy interest rate, inflation remains persistently high and above the central bank’s target range. The most recent announcement by OPEC to reduce oil production will not help tame this beast. Although inflation has retracted from its peak in mid-2022, the cost of putting food on the table has stretched the budget of many families across Canada. Furthermore, Albertans carry one of the highest household debt-to-income ratios across Canada. Higher debt servicing costs will leave less money available for personal consumption, which makes up the largest portion of GDP and weighs heavily on future economic growth.

Fortunately, Alberta’s strong performance in the energy and agricultural sector will cushion the blow from the foreseeable economic slowdown. Additionally, population growth will help mitigate declining domestic GDP, labour shortages, and falling real estate values and provide more provincial tax revenue.

Fiscally, Alberta was able to dedicate $13.4 billion toward debt repayment. Revenues, primarily inflated due to energy royalties provided a tremendous boost toward 2023 budgeted public expenditures and capital investment. Additional surpluses are expected to continue over the next few years, thanks to high energy prices and OPEC’s intervention in the oil market. The introduction of a balanced budget mandate and a ceiling on spending tied to inflation and population will keep fiscal spending in check.

The 2023 Federal budget, with an astounding projected $43B annual deficit, included hefty spending on health care, affordability support and green investments. Construction will benefit from combined federal and provincial spending on health care and green technology and much-needed provincial capital investment in education, municipal infrastructure, recreation and affordable housing.

Looking Forward

Fortunately, we live in a peaceful country that has a secure and reliable financial system, stable currency, strong government policies that promote business and an independent justice system to prevent corruption – characteristics of a strong market economy that attracts domestic and foreign investment.

Along with a favourable business environment, government investment into green technology, infrastructure and other capital expansion projects will benefit the Alberta metal building industry. Non-residential construction is forecast to remain strong out to 2027, with several large industrial expansion projects on the horizon.

Although Alberta is not immune to global geopolitical, environmental and economic risks, the abundance of natural resources, thriving agriculture and energy sectors and the elevated price of commodities will buffer the sting of the global economic slowdown.