State of the Industry

By: Linda Giesinger | October 2022

Since the discovery of oil in Alberta, the province has been struggling through bust and boom economic cycles, but this last boom has been very different: complicated by rampant inflation, a global pandemic, climate change and a war in Europe.

Energy service and drilling rigs are once again in full force and reported record breaking output of oil and gas for this year. Energy companies offering high wages are squeezing out the construction industry for skilled workers. Furthermore, metal building erectors retiring is worsening the shortage of erectors in the province with many AMBA members reporting ongoing difficulty in sourcing labour.

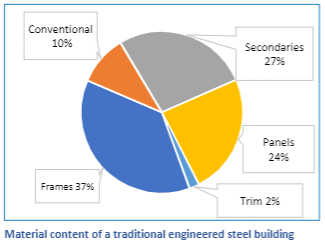

Rising interest rates show no signs of softening inflation, yet metal building manufacturers are reporting better lead times with lower pricing as steel prices and demand decrease. US hot rolled coil (HRC) prices are currently at a 22 month low. Although a typical metal clad engineered steel building comprises of approximately 75% of HRC, there are finishes and costs (galvanizing, primer and finish paint) that add to the steel input cost. About 50% of the frames comprising of webs up to 3/8” thick are made from HRC with the balance (flanges, plates etc.) made from plate. The graph below, provided by Butler Manufacturing, illustrates the material content of a typical engineered steel building. Additional metal building manufacturing costs (processing, freight, overhead and labour) has further increased indirect and direct costs to a building.

Data

Statistics Canada reported a 25% increase in residential construction costs and 13% increase in non- residential costs in Q1 of 2022. Although the cost of some construction raw materials has declined, others like concrete and concrete related products, gypsum board and electrical components have skyrocketed. Additionally, freight and exchange rate volatility has added another layer of unpredictability to construction pricing.

Despite cost increases, non-residential construction activity posted gains of 17% year over year as of July 2022, commercial construction accounted for a third of that gain. Industrial investment, particularly in mining and agriculture, is gaining momentum.

On the Horizon

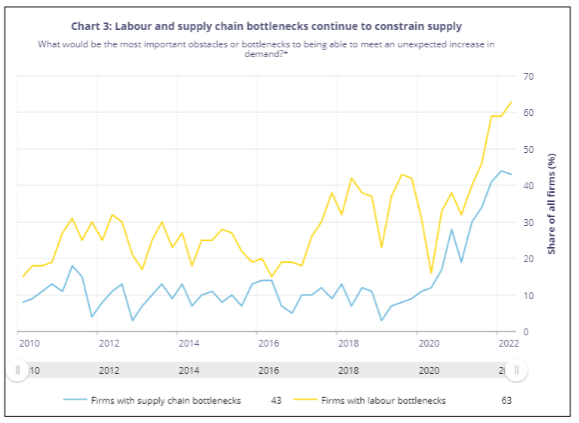

The Bank of Canada’s second quarter Business Outlook Survey indicated labour shortages and supply chain bottlenecks as the two most prominent concerns impacting business growth. Although many Canadian businesses reported optimism, they did not plan to increase investment over the next year.

Significant wage and price increases appear to be entrenched. As central banks struggle to get inflation under control with several interest rate hikes, it is creating uncertainty in the stock market and eroding consumer confidence.

Despite the higher cost of borrowing, the energy sector is planning to increase capital investment, although it will be much lower than previous energy price booms. Growth is expected to remain strong, but labour constraints will be a limiting factor. Widespread labour shortages will likely persist due to an aging population and strong competition for workers.

Looking Forward There are some positive signs and initiatives that will help our province through navigating an unpredictable and volatile global economy:

Interprovincial migration: In the past year Alberta has experienced a boom in interprovincial migration. In the second quarter of this year, more than 10,000 people moved to the province with most of those being younger workers.

Alberta Is Calling Campaign: Recently launched by the provincial government to attract skilled labour from other provinces to fill more than 100,000 job vacancies.

Provincial fiscal surplus: A whopping $13.2 billion estimated surplus, due to high energy prices, will result in more provincial spending on programs and infrastructure.

Exported goods: The Transmountain pipeline will be operational in 2023 and will result in more crude and refined oil export capacity. Additionally, Alberta farmers had an exceptional wheat crop this year with Alberta farmers reporting their best harvests in five years (Business Council of Alberta).

Low unemployment rate: Alberta’s unemployment rate is below the national average with a job creation rate of 5.6% year over year to date (https://economics.td.com/provincial-economic-forecast).

GDP: Alberta is forecast to lead the country in GDP growth for 2022 and 2023.

Alberta is finally in a favourable position to weather the next storm...